Mergers and acquisitions (M&A) are set to accelerate in 2025, building on last year’s momentum as economic conditions stabilize. Through September 2024, M&A volumes climbed 17% year-over-year, fueled by corporate consolidations and private equity (PE) transactions.

The security industry is keeping pace, with 186 deals recorded through December 20, 2024, closely tracking the 190 transactions in 2023. Driving this surge is a favorable regulatory climate and nearly $3 trillion in uncommitted capital, creating prime conditions for dealmaking.

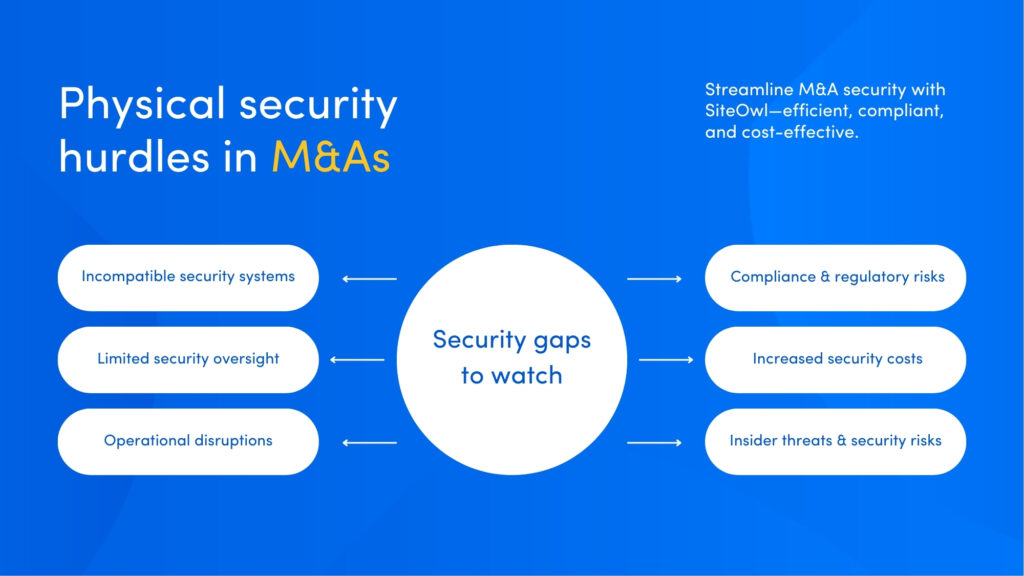

But while M&A opens doors for growth, untangling physical security infrastructure is a logistical nightmare. Organizations inherit fragmented system inventories, scattered vendor contracts, and little to no visibility into the security technology they now own.

Here are four key areas security leaders should focus on to reduce risks and maintain control during an M&A transition.

1. Standardizing security across merged entities

Mergers bring together different teams, technologies, and policies, but they also create a complicated mix of security infrastructure. Each acquired entity comes with its own access control systems, surveillance networks, and security protocols, many of which were never designed to work together.

The result is a combination of operational inefficiencies, compliance risks, and security blind spots that put the entire organization at risk.

Without a standardized approach, security teams waste time, money, and resources trying to merge incompatible systems while ensuring business continuity.

One of the biggest issues? Badge compatibility.

M&A challenge spotlight: Nokia & Alcatel-Lucent

Nokia’s 2016 acquisition of Alcatel-Lucent is a well-documented example of how difficult it can be to integrate security systems after a merger. Each company relied on different physical access control systems—Nokia used Lenel, while Alcatel-Lucent used AMAG.

These systems were not compatible, which created significant challenges in unifying security operations. This mismatch required manual reprogramming of approximately 18,000 employee badges, leading to increased costs, delays, and operational disruptions.

With a centralized security lifecycle management platform, security teams could have:

- Accessed a real-time inventory of security assets across all locations.

- Identified incompatibilities early and developed an integration plan.

- Ensured a smooth transition without unnecessary delays or unexpected costs.

But “should’ve, could’ve, would’ve” are the last things security teams want to hear after a merger. Without complete visibility into your physical security infrastructure, even the best integration plans can fall apart.

2. Centralizing infrastructure data for better oversight

Mergers often leave security teams digging through outdated, incomplete, and disconnected information about their newly acquired infrastructure. Asset inventories are scattered across spreadsheets, system documentation is inconsistent, and floorplans rarely reflect reality.

Without a reliable source of truth, security teams waste valuable time tracking down critical details—only to find that the information is outdated, inaccurate, or missing altogether.

And spreadsheets? They only make matters worse. While Excel is one of the most widely used business tools, it’s also one of the most error-prone—leading to costly mistakes, inefficiencies, and operational roadblocks.

M&A Challenge Spotlight: The Spreadsheet Trap

Take Johnson Financial, for example. The company relied on spreadsheets to track approximately 8,000 IT devices —a process that consumed hundreds of hours every year and was plagued with inaccuracies.

Manually updated data meant security teams never had a real-time view of assets, leading to delayed decision-making, operational inefficiencies, and increased costs.

Now, imagine this scenario in the context of a multi-location security infrastructure post-M&A. With thousands of cameras, access control points, and alarm systems to track, relying on static spreadsheets leaves organizations exposed to security gaps, compliance risks, and budget overruns.

A centralized security lifecycle management platform eliminates these challenges by:

- Aggregating all security asset data into a single, real-time platform

- Providing interactive digital floorplans for a visual, location-based view of infrastructure

- Eliminating manual tracking to reduce errors and outdated information

With a clear, unified view of security assets, organizations can make faster, data-driven decisions—whether it’s planning upgrades or optimizing system performance. Instead of spending months untangling scattered records, security leaders gain instant oversight and control.

3. Accelerating security integration during M&A transition

The onboarding and implementation of new security systems post-M&A can take months, delaying operational readiness and increasing security risks.

With multiple locations, vendors, and legacy systems in play, even basic security upgrades can turn into slow, disjointed projects—leaving gaps in coverage and disrupting business operations.

Yet, if you search for guidance on security during M&A, you’ll find an overwhelming focus on cybersecurity—while physical security often takes a backseat. However, ignoring physical security integration during an acquisition can be just as dangerous.

Incompatible access control systems, unmonitored entry points, and fragmented surveillance networks all create leave newly merged organizations vulnerable to internal and external threats

With a structured approach and a centralized security lifecycle management platform, organizations can speed up the transition by:

- Providing a real-time implementation roadmap to track security projects across locations

- Standardizing infrastructure data so security teams can identify and prioritize gaps

- Streamlining vendor coordination to ensure installations and upgrades stay on schedule

4. Reducing costs and mitigating risk in security investments

Mergers and acquisitions (M&A) often come with substantial expenses, and security infrastructure is no exception.

Amajor challenge is that sellers rarely consider the state of their physical security infrastructure when preparing for an acquisition. This oversight often leads to unexpected costs, integration hurdles, and security gaps that require expensive fixes post-merger.

60% of companies have encountered breaches in their physical security measures, with the average cost of addressing a physical security breach estimated at approximately $100,000.

Despite these risks, physical security is often an afterthought in M&A planning. Unlike IT and finance teams—who play a central role in due diligence—security teams are often brought in late in the process, after key decisions have already been made.

As a result, they are left scrambling to assess risks, align security programs, and justify unexpected costs to leadership.

Centralization + Visibility = Smarter security investments

Making informed security decisions during an M&A requires more than just a checklist—it demands real-time data and complete visibility into every security asset.

A centralized security lifecycle management platform helps organizations navigate M&A security challenges proactively, rather than reactively. With SiteOwl, security teams can:

- Identify redundant or underutilized assets to eliminate unnecessary costs before they spiral

- Optimize vendor contracts by consolidating services and renegotiating agreements

- Gain real-time, data-driven insights to prioritize upgrades based on performance and risk

By assessing security infrastructure early in the M&A process, organizations can reduce costs, mitigate risks, and prevent security surprises—ensuring a smoother transition and stronger long-term security strategy.

SiteOwl simplifies physical security during M&A

Mergers and acquisitions are complex enough—security shouldn’t add to the chaos. Without the right tools, organizations risk inheriting disorganized infrastructure, fragmented vendor relationships, and costly inefficiencies that can delay integration and weaken security.

SiteOwl changes the equation by giving security teams real-time visibility, a structured approach, and better coordination to stay ahead of challenges and keep operations running smoothly.

Whether you’re integrating a single facility or aligning security across a global portfolio, SiteOwl gives you the clarity and control you need to turn security challenges into a competitive advantage.

Ready to simplify security integration in your next M&A deal? Let’s talk.

Su Subburaj

Su is SiteOwl's CMO and leads all marketing and communications. Su has extensive strategy and management consulting experience and previously consulted for 3Sixty Integrated where she gained an in-depth understanding of digital transformation challenges in the physical security industry. When not working on strategies to expand SiteOwl's footprint, Su enjoys bad karaoke, weightlifting and traveling.